ISLAMABAD: Prime Minister Shehbaz Sharif on Tuesday met United Arab Emirates (UAE) President Sheikh Mohamed bin Zayed Al-Nahyan in Abu Dhabi, Sharif’s office said, adding the two leaders discussed ways to deepen economic cooperation between the two countries to achieve sustainable growth.

The meeting took place on the sidelines of the World Governments Summit (WGS), being held in Dubai on Feb. 11-13 under the theme ‘Shaping Future Governments.’ This is Sharif’s second visit to the UAE since assuming office in March last year.

The UAE is Pakistan’s third-largest trading partner after China and the United States, and a major source of foreign investment valued at over $10 billion in the last 20 years, according to the UAE’s foreign ministry.

Both countries have stepped up efforts in recent years to strengthen their economic relations. In Jan. 2024, Pakistan and the UAE signed multiple agreements worth more than $3 billion for cooperation in railways, economic zones and infrastructure.

“During their meeting at Qasr Al Shati in Abu Dhabi, the Prime Minister and His Highness discussed ways to deepen cooperation between Pakistan and the UAE and explored opportunities to enhance mutual interests,” Sharif’s office said.

“The talks focused on economic, trade, and development fields, alongside other areas that align with both nations’ visions for sustainable economic growth and prosperity.”

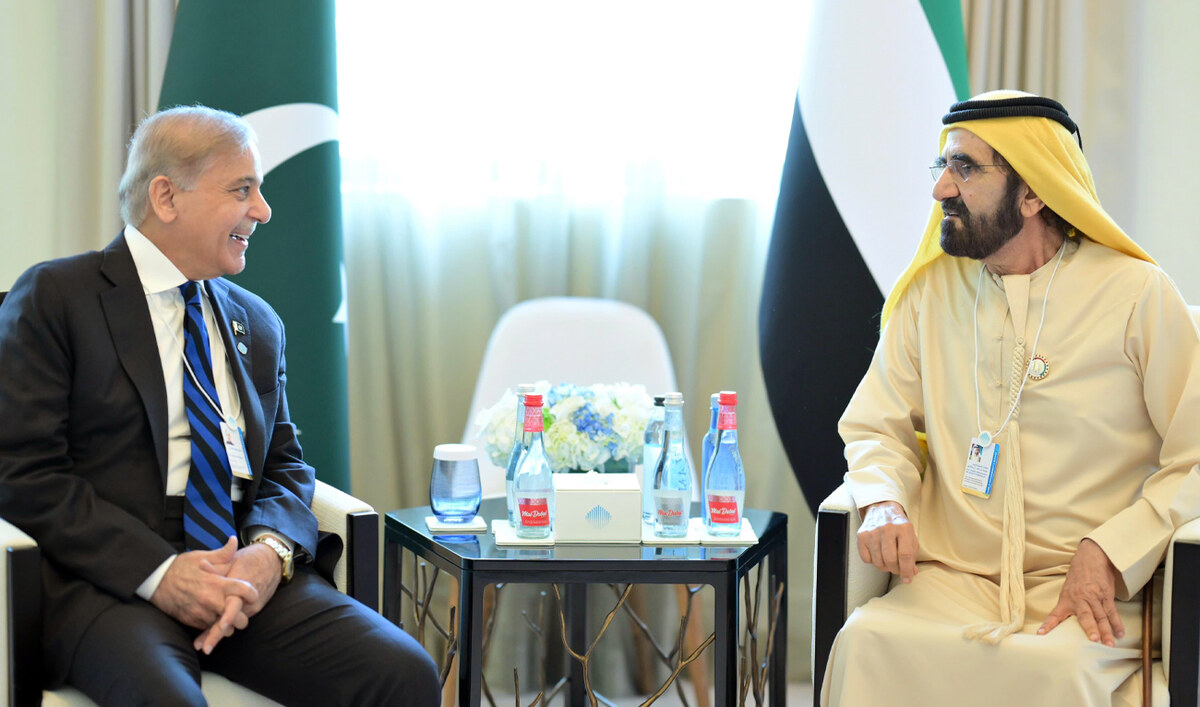

Pakistan‚Äôs Prime Minister Shehbaz Sharif¬Ýmeets United Arab Emirates (UAE) Prime Minister Sheikh Mohammed bin Rashid Al Maktoum, on the sidelines of the World Governments Summit 2025, in Dubai on February 11, 2025. (PMO)

Policymakers in Pakistan consider the UAE an optimal export destination due to its geographical proximity, which minimizes transportation and freight costs while facilitating commercial transactions. It is also home to more than a million Pakistani expatriates, making it the second-largest Pakistani expatriate community worldwide and a major source of foreign workers’ remittances for Pakistan.

The meeting provided an opportunity to address the significance of the World Governments Summit in identifying global trends in governance and presenting actionable strategies to enhance government preparedness in navigating global transformations, according to Sharif’s office. The discussions underscored the importance of leveraging these shifts to accelerate development and build a better future for all.

Sharif is also meeting foreign companies and investors on the WGS sidelines as Pakistan, currently bolstered by a $7 billion facility from the International Monetary Fund (IMF) granted in September, navigates a narrow economic recovery path.

In one meeting, Sharif met with the Dubai-owned ports and logistics company DP World’s CEO Sultan Ahmed bin Sulayem and discussed ongoing and future investments.

“Sharif appreciated DP World’s investment in Pakistan and its role in enhancing trade and logistics infrastructure,” the PM’s office said in a statement, reiterating Pakistan’s commitment to the early completion of projects under two Inter-Governmental Framework Agreements (GAs) signed in Jan. 2024 to strengthen relations in the marine and logistics sectors, including the establishment of a freight corridor and an economic zone near Karachi, the Pakistani commercial capital.

Pakistan Prime Minister Shehbaz Sharif shakes hands with Sultan Ahmed bin Sulayem, Group Chairman and CEO DP World, during a meeting on the sidelines of the World Governments Summit in Dubai on February 11, 2025. (Photo courtesy: PMO)

“[Sharif] said that Pakistan’s strategic location provides an ideal opportunity for DP World to expand its operations and emulate successful projects like Jebel Ali Port in Pakistan,” the PM office said.

Under the IGAs, DP World is developing a dedicated freight corridor to run from Karachi Port on the Arabian Sea, passing through Karachi, Pakistan‚Äôs most populous city, to the Pipri Marshalling Yard, approximately 45km away. The corridor will improve efficiency, transport times, and reduce the overall cost of logistics. State-run Pakistan Railways and Port Qasim Authority will act on behalf of the Pakistan government for the development of the corridor.¬Ý

A second framework agreement was signed with Pakistan‚Äôs ministry of maritime affairs to dredge the navigation channel. DP World will carry out the capital dredging on behalf of the government of Dubai.¬Ý

The framework agreement will also see the development of an economic zone at Port Qasim, which aims to attract more than US $3 billion foreign direct investment. DP World, on behalf of the government of Dubai, will carry out the development of the economic zone, with the aim of maximizing economic activity in Pakistan.¬Ý

DP World began operations in Pakistan in 1997 at the Qasim International Container Terminal (QICT) – the first of its kind in the country – and has since transformed the facility into a leading gateway for global trade in the region.

Pakistan Prime Minister Shehbaz Sharif meets US businessman and Texas hedge fund manager Gentry Beach (2L) on the sidelines of the World Governments Summit in Dubai on February 11, 2025. (Photo courtesy: PMO)

Separately, Sharif met US businessman and Texas hedge fund manager Gentry Beach, who is close to the family of American President Donald Trump. Beach visited Pakistan last month and discussed investments in the real estate, energy and minerals sectors.

“Beach, while recalling his recent visit to Pakistan, described the government’s policies as conducive for business and investment and expressed keen interest in investing in various sectors,” Sharif’s office said in a statement, adding that the US investor had pledged to “implement his investment plans in Pakistan at the earliest.”